Abstract

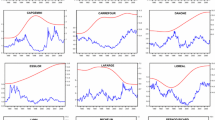

This paper applies a model of fundamental share prices based on a bounded dividends process, with earnings as the upper bound, to assess the deviations of actual prices for over- and under-valuations. The fundamental model extends the traditional present value of future dividends analysis to allow for the effect of an earnings-dividends trade-off effect. The simple fundamental model includes a closed form share price solution which may be calibrated to generate fundamental values from which to assess actual prices for over or under valuations. The properties of the model are explored with a simulation example. The empirical example is based on S&P data and the analysis provides evidence of persistent over-valuations since the late 1990’s. Expressed another way, the analysis highlights the role of factors, other than dividends and earnings in the determination of actual asset prices since the late 1990s.

Similar content being viewed by others

Author information

Authors and Affiliations

Corresponding author

Additional information

I would like to thank an anonymous refree for very useful comments.

First version received: July 2002/Final version received: March 2004

Rights and permissions

About this article

Cite this article

Lim, G.C. Bounded dividends, earnings and fundamental stock values. Empirical Economics 30, 411–426 (2005). https://doi.org/10.1007/s00181-005-0240-1

Issue Date:

DOI: https://doi.org/10.1007/s00181-005-0240-1