Abstract

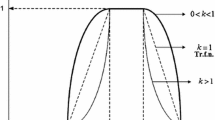

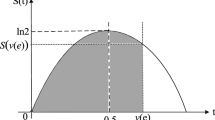

We consider a discrete-time model for the cash flow of an insurance portfolio/business in which the net losses are random variables, while the return rates are fuzzy numbers. We choose the shape of these fuzzy numbers trapezoidal, Gaussian or lognormal, the last one having a more flexible shape than the previous ones. For the resulting fuzzy model, we evaluate the fuzzy present value of its wealth; then, we propose an approximation for the chance of ruin and a ranking criterion which could be used to compare different risk management strategies.

Similar content being viewed by others

References

Andrés-Sánchez, J., González-Vila Puchades, L.: Using fuzzy random variables in life annuities pricing. Fuzzy Sets Syst. 188, 27–44 (2012)

Asmussen, S., Albrecher, H.: Ruin Probabilities. World Scientific, Singapore (2010)

Bortolan, G., Degani, R.: A review of some methods for ranking fuzzy subsets. Fuzzy Sets Syst. 15(1), 1–19 (1985)

Buckley, J.J.: The fuzzy mathematics of finance. Fuzzy Sets Syst. 21, 257–273 (1987)

Carlsson, C., Fuller, R.: On possibilistic mean value and variance of fuzzy numbers. Fuzzy Sets Syst. 122(1), 315–326 (2001)

Chen, S.J., Hwang, C.L.: Fuzzy Multiple Attribute Decision Making. Springer, Berlin (1992)

Chiu, C.Y., Park, C.S.: Fuzzy cash flow analysis using present worth criterion. Eng. Econ. 39(2), 113–138 (1994)

Fortemps, P., Roubens, M.: Ranking and defuzzification methods based on area compensation. Fuzzy Sets Syst. 82(3), 319–330 (1996)

Gao, S., Zhang, Z.: Multiplication operation on fuzzy numbers. J. Softw. 4(4), 331–338 (2009)

Huang, T., Zhao, R., Tang, W.: Risk model with fuzzy random individual claim amount. Eur. J. Oper. Res. 192, 879–890 (2009)

Kaufmann, A., Gupta, M.M.: Fuzzy Mathematical Models in Engineering and Management Science. Elsevier, Amsterdam (1988)

Kruse, R., Meyer, K.: Statistics with Vague Data. Reidel, Dordrecht (1987)

Kwakernaak, H.: Fuzzy random variables I: definitions and theorems. Inf. Sci. 15, 1–29 (1978)

Lemaire, J.: Fuzzy insurance. Astin Bull. 20(1), 33–56 (1990)

Liu, Y., Liu, B.: Fuzzy random variables: a scalar expected value operator. Fuzzy Optim. Decis. Mak. 2, 143–160 (2003)

Ostaszewski, K.: Fuzzy Sets Methods in Actuarial Science. Society of Actuaries Monograph, Schaumburg (1993)

Puri, M., Ralescu, D.: Fuzzy random variables. J. Math. Anal. Appl. 114, 409–422 (1986)

Shapiro, A.F.: Fuzzy logic in insurance. Insur. Math. Econ. 35, 399–424 (2004)

Tang, Q., Tsitsiashvili, G.: Finite- and infinite-time ruin probabilities in the presence of stochastic returns on investments. Adv. Appl. Probab. 36(4), 1278–1299 (2004)

Terceno, A., De Andres, J., Belvis, C., Barbera, G.: Fuzzy methods incorporated to the study of personal insurances. Fuzzy Econ. Rev. 2(1), 105–119 (1996)

Vernic, R., Ungureanu, D.: On two particular fuzzy numbers derived from probability distributions. Sci. Bull. Univ. Pitesti—Math. Inf. Ser. 17, 101–112 (2011)

Ward, T.L.: Fuzzy discounted cash flow analysis. In: Evans, G.W., Karwowski, W., Wilhelm, M.R. (eds.) Applications of Fuzzy Set Methodologies in Industrial Engineering, pp. 91–102. Elsevier, Amsterdam (1989)

Acknowledgments

The authors gratefully acknowledge the two anonymous referees for insightful questions and suggestions that helped them to revise and significantly improve the paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ungureanu, D., Vernic, R. On a fuzzy cash flow model with insurance applications. Decisions Econ Finan 38, 39–54 (2015). https://doi.org/10.1007/s10203-014-0157-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10203-014-0157-2

Keywords

- Fuzzy numbers

- Fuzzy random variables

- Fuzzy discrete-time cash flow model

- Insurance

- Risk management

- Ruin

- Ranking